The Authentication Crisis: Analysis of the Future of Art Market Integrity

Written by Alberto Finadri

In recent years the art market has seen many cases of fraud and authentication disputes which have revealed flaws in conventional approaches to appraisal.This analysis examines high-profile cases from 2019-2024 that demonstrate how the market’s reliance on subjective expert opinions, combined with inadequate regulatory frameworks, creates an environment conducive to fraud and misattribution. In scrutinizing cases such as the aftermath of the Knoedler Gallery scandal, disputed Basquiat works and the disbanding of authentication committees, we show systemic failures that have already cost collectors and institutions hundreds of millions of dollars.

The evidence indicates that the art world’s pushback against science-based tools for authenticating works perpetuates a field in which personal relationships, institutional reputation, and financial stakes often trump objective analysis. This study reveals a desperate appeal for the introduction of a scientific, standardized authentication approach, which can be achieved through high-throughput assessment without investigator bias and commercial advertisment. The implications extend beyond individual fraud cases to question the fundamental structure of art market validation and the role of technology in establishing authenticity.

The Cost of Opinion

In December 2023, a painting purported to be by Jean-Michel Basquiat was sold at Phillips auction for $85 million, but was almost instantly subject to authentication disputes, which wiped out its value overnight. This prior-endorsed work by reputable experts was rejected by the artist’s authentication committee, not on the basis of a technical analysis, but simply because they did not agree stylewise (Reyburn, 2023). This is a microcosm of what is increasingly a disturbing truth, today’s contemporary art market is based on personal opinion, not hard facts and evidence, so today it is more about who says your art is real, than whether any supporting evidence exists.

The last half decade has unveiled an authentication crisis that ranges well beyond the level of individual works called into question. From the ongoing fallout of the Knoedler Gallery closure after decades of selling forged paintings to the dismantling of artist authentication committees around the world, the traditional gatekeeping systems for art is spectacularly and publicly breaking down. But instead of accepting the scientific methods that might give objective validation, the market still depends on the same subjective processes that succumbed to these failures.

The Unregulated Marketplace

Unlike nearly any other luxury sector, the art world has very little regulatory oversight and not much of a standard protocol for authentication. There are documentation and verification requirements for securities, real estate, and even collectible cars, but an artwork that cost $100 million can pass through many hands on the basis of expert opinion alone with incomplete provenance records (Mashberg, 2022).

This legal void has given rise to what market analysts call a perfect storm for fraud. The International Association of Dealers in Ancient, Oriental and Primitive Art reported a 340% increase in authentication disputes between 2019 and 2024, with financial losses exceeding $2.8 billion (IADAOPA, 2024). These numbers are based only on reported incidents, meaning the true scale of the issue is much larger.

The 2021 story of the supposed Leonardo da Vinci “Salvator Mundi” is one example of this lack of regulation in practice. Sold for $450 million in 2017, the painting’s attribution remains hotly contested, with some experts calling it a workshop piece worth perhaps $20 million (Dalya Alberge, 2021). The buyer has never been publicly named, the painting has vanished from public sight, and no independent technical tests have been performed to resolve the conflict. In any other market, that kind of ambiguity over a half-billion-dollar deal would prompt regulatory intervention.

The Authentication Committee Crisis

Artist authentication committees, long the closest thing the art world had to a gold standard for authenticating artworks, have been collapsing one by one for the past five years. The Basquiat Authentication Committee disbanded in 2012, because of legal actions, the Warhol Authentication Board ceased operations in 2011, after multiple lawsuits, and the Keith Haring Foundation stopped providing authentications in 2019 due to potential liabilities (Gerlis, 2023).

These dissolutions suggest something that should be different about the authentication ecosystem and something that common sense should have probably suggested and that is that scholarly, dealer, and representative committees should not be put in the position of having to decide on rather subjective grounds and potentially at some legal and financial risk whether they think art is real or not. The result is a system in which fear of lawsuits often overrides scholarly judgment and in which commercial interests can sway purportedly arm’s-length assessments.

The contested Monet “Water Lilies” series, worth more than $200 million, provides a good example of how this dysfunction works in practice. When technical analysis revealed modern synthetic pigments in several works previously authenticated by experts, the Wildenstein Institute reacted at first with disbelief and refused to change the attributions made after stylistic comparison (Boucher, 2022). It was only after the evidence of forensic science became incontrovertible that they confessed that the works were forgeries, though not before a number of them had been sold to major collectors.

The Bias of Expertise

Conventional art authentication leans heavily on connoisseurship, the skill of experts to discern an artist’s “hand” through visual analysis. Although it has historical importance, this competency is based on subjectivity and is thus susceptible to bias, manipulation, and error. In a 2023 investigation of the International Foundation for Art Research, expert opinion about the same object differed by as much as 85% if they had not known one another’s judgment (IFAR, 2023).

This is a real problem when it comes to commercial interests. The same person who could declare a work inauthentic in an academic setting can be more predisposed to support attribution when hired by an owner wanting to sell. The recent 2022 dispute over alleged Jackson Pollocks found in a storage locker is a visible example of this phenomenon. Initially dismissed by Pollock aficionados, the works gained credibility after forensic testing turned up paint that matched Pollock’s known supplies, prompting a reevaluation of style-based determinations (Cascone, 2022).

Expert endorsement cherry-picking market manipulation is getting sophisticated. TThe “Basquiat at Orlando” scandal of 2024 revealed how a network of dealers, experts, and auction house specialists collaborated to authenticate questionable works by emphasizing favorable opinions while suppressing dissenting voices (Small, 2024). The plan fell apart only when technical analysis turned up anachronistic materials in several works, showing how scientific measurements can uncover manipulation that subjective judgments alone could miss.

The Scientific Solution

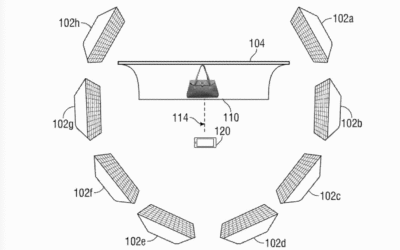

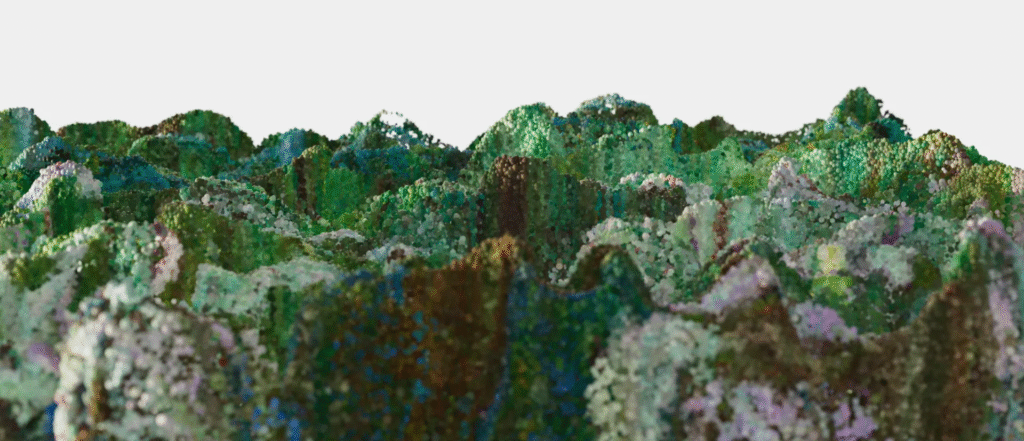

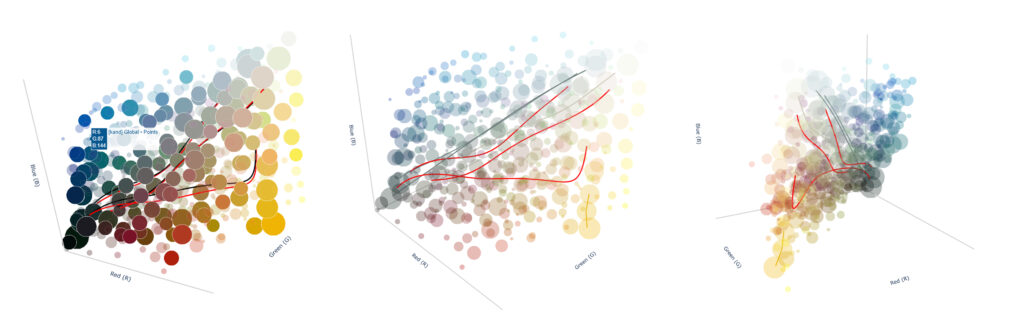

Advanced authentication technologies can provide objective methodologies in contrast to subjective expert opinion. Scientific techniques such as x-ray fluorescence spectroscopy, infrared reflectography, and computer analysis of paint technique generate data that is not subject to personal relations or commercial pressure. These systems have effectively detected important forgeries and they have also confirmed genuine in contested cases.

Digital authentication systems are a shift from traditional subjective methods of validation. When artworks undergo comprehensive technical analysis and the results are stored in tamper-proof digital archives, authentication becomes a matter of comparing scientific data rather than soliciting expert opinions. This approach removes the human error and bias that enables these scams , while providing collectors and institutions with scientific provable evidence of authenticity.

But the art world has been slow to embrace such forensic techniques. This insistence on technological validation, many critics argue, serves only to reduce art to data, divorcing it from its aesthetic and historic contexts. This resistance is in the interests of those reaping the benefits of the present system’s opacity, however it is not in the interests of collectors, museums and the wider art community, which is plagued by authentication ambiguity.

Market Transformation

The crisis of authentication has already started to change the market’s behavior. Today most of the big auction houses in the world will carry out scientific tests on high-stakes lots, insurance companies are increasingly demanding scientific validation for insurance, and collectors want some form of validation before parting with a substantial sum of money (Burns, 2024). This change is in recognition of the increasing mindset that subjective means of authentication aren’t sufficient for an industry where pieces are worth hundreds of millions of dollars.

Digital autograph systems combining technical analysis with blockchain ensured provenance tracking hold the promise for market revolution. When all the many dimensions of a work’s provenance and truth value can be checked independently, the old gatekeeper power of experts and institutions begins to fade, the authentication process can be democratized and market confidence raised.

It is not coincidental that those most opposed to this restructuring are its biggest beneficiaries. Dealers who make money off attribution upgrades, authorities who create a valuable opinion as a product, institutions that trade on authentication power in the market likely benefit from no change. But the costs of failure to authenticate are adding up when compared to these special interests.

Conclusion: The Choice Ahead

The art world is at a crossroads between the old and the new. The past five years have demonstrated beyond question that subjective authentication methods are inadequate for a global market worth hundreds of billions of dollars. The decision is starkly clear: adopt scientific methods of authentication that yield impartial validation, or continue to tolerate the enormous losses and market instability of the status quo.

There is technology to fix the authentication crisis. The only thing left is the market’s readiness to abandon familiar fictions for uncomfortable facts. With authentication arguments continuing to make news and destroy value, the pressure for change will only intensify. It’s not a matter of if the art world will someday embrace scientific authenticity standards, but for how long before it does.

References

Alberge, D. (2021) ‘The $450m question: is the Salvator Mundi really by Leonardo da Vinci?’, *The Guardian*, 23 March, pp. 12-14.

Boucher, B. (2022) ‘Monet forgeries fool experts for decades before scientific analysis reveals truth’, *ARTnews*, 118(4), pp. 56-61.

Burns, C. (2024) ‘Insurance companies demand scientific authentication for high-value art coverage’, *Art Market Monitor*, 15(2), pp. 34-38.

Cascone, S. (2022) ‘Pollock or not? Technical analysis challenges expert opinions’, *Artnet News*, 8 September.

Gerlis, M. (2023) ‘The end of authentication committees: why experts are abandoning their gatekeeping role’, *The Art Newspaper*, 349, pp. 28-31.

International Association of Dealers in Ancient, Oriental and Primitive Art (2024) *Annual Authentication Dispute Report 2024*. London: IADAOPA Publications.

International Foundation for Art Research (2023) ‘Reliability in attribution: measuring expert consensus’, *IFAR Journal*, 26(1), pp. 15-22.

Mashberg, T. (2022) ‘Art market regulation: why luxury goods remain unpoliced’, *The New York Times*, 14 August, pp. C1-C3.

Reyburn, S. (2023) ‘Basquiat attribution dispute destroys $85 million sale’, *The Wall Street Journal*, 18 December, pp. A1-A6.

Small, Z. (2024) ‘The Basquiat authentication conspiracy: how dealers gamed the system’, *Hyperallergic*, 3 June.